rhode island state tax withholding

A person is domiciled outside Rhode Island but is living in a home maintained by him in Rhode Island for more than 183 days of the tax year and therefore is considered a resident for the personal income tax purposes of this state. Before the official 2022 Rhode Island income tax rates are released provisional 2022 tax rates are based on Rhode Islands 2021 income tax brackets.

2020 W 4 Form Example Filled Out

Latest Tax News.

. With rare exceptions if your small business has employees working in the United States youll need a federal employer identification number EIN. Read the summary of the latest tax changes. A the employees wages are subject to Federal income tax withholding and b any part of the wages were for services performed in Rhode Island 280-RICR-20-55-106C1.

We allow for estimated payments extension payments payments with a tax filing license renewal payments bill payments and payments for various fees. No action on the part of the employee or the personnel office is necessary. The annualized wage threshold where the annual exemption amount is eliminated has changed from 231500 to 234750.

505 Tax Withholding and Estimated Tax. Martha Martinez a nonresident is selling property in Rhode Island and 20 days before the closing elects the gain method of withholding by computing the RI 713 Election form and sending it to the Division of Taxation. Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages.

Up to 25 cash back Here are the basic rules on Rhode Island state income tax withholding for employees. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding. No action on the part of the employee or the personnel office is necessary.

Office of the Governor Secretary of State RIgov Elected Officials State Agencies A-Z State. RI Division of Taxation. Divide the annual Rhode Island tax withholding by 26 to obtain the.

The 2022 state personal income tax brackets are updated from the Rhode Island and Tax Foundation data. Withholding Tax Filing Due Date Calendar 2020 2020 Withholding Tax Filing Due Date Calendar PDF file less than 1 mb megabytes RI W-4 2021 Employees Withholding Certificate - 2021 PDF file less than 1 mb megabytes. Masks are required when visiting Divisions office.

The annualized wage threshold where the annual exemption amount is eliminated has increased from 227050 to 231500. The income tax withholding for the State of Rhode Island includes the following changes. RI Division of Taxation - Employer Tax Section - 401-574-8700 Option 2.

If you are not ready to transition to the Tax Portal we also support various legacy. A Rhode Island employer must withhold Rhode Island income tax from the wages of an. You may claim exemption from withholding for 2022 if you meet both of the following conditions.

State of Rhode Island. The income tax wage table has changed. Rhode Island Taxable Income Rate.

The income tax wage table has changed. Withholding and when you must furnish a new Form W-4 see Pub. Income tax withholding account including withholding for pensions or trusts Rhode Island Unemployment insurance account including Rhode Island temporary disability insurance TDI and Rhode Island job development fund tax.

You will need a completed Business Application and Registration Form along with the 10 fee. EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD. Please note that for applications for new businesses beginning on or.

Withholding Formula Rhode Island Effective 2021. The income tax withholding for the State of Rhode Island includes the following changes. The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates.

The annualized wage threshold where the annual exemption amount is eliminated has changed from 234750 to 241850. Multiply the adjusted gross biweekly wages times 26 to obtain the gross annual wages. RI Employer Tax Section 401-574-8700 Option 1 - unemployment and TDI.

The income tax withholding for the State of Rhode Island includes the following changes. RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax registration only questions. A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if.

1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island. You should obtain your EIN as soon as possible and in any case before hiring your first employee. PPP loan forgiveness - forms FAQs guidance.

The Rhode Island tax liability before any withholding or credits is 800 and his tax liability to State X before. You had no federal income tax liability in 2021 and you expect to have no federal income tax liability in 2022. Generally Rhode Island withholding is required to be withheld from the wages of an employee by a Rhode Island employer.

Rhode Island tax forms are sourced from the Rhode Island income tax forms page and are. However if Annual wages are more than 241850 Exemption is 0. 2022 Filing Season FAQs - February 1 2022.

Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. Thank you for using the Rhode Island online registration service. Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount.

The table below shows the income tax rates in Rhode Island for all filing statuses. The income tax wage table has been updated. The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state.

If you need help getting started feel free to call us at 4015748484 or email at taxportaltaxrigov. Rhode Island employer means an employer maintaining an office or transacting business within this state. A resident is defined as anyone who is domiciled in the state or who spends 183 days of a tax year in.

Technical Problems with the online application - 401-831-8099.

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

Withholding Allowances Payroll Exemptions And More

Tax Withholding For Pensions And Social Security Sensible Money

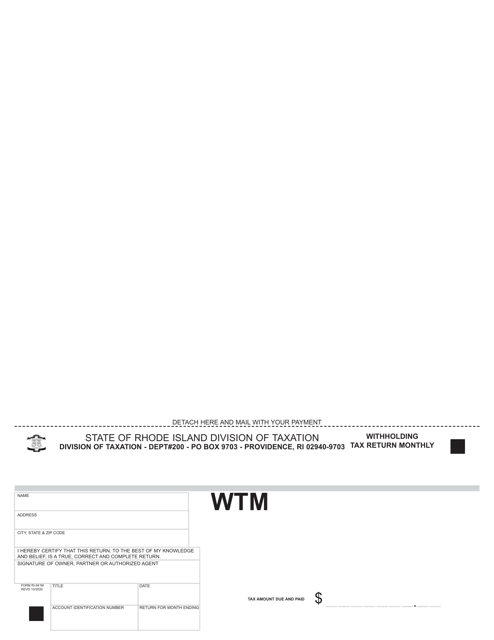

Form Ri 941m Download Fillable Pdf Or Fill Online Withholding Tax Return Rhode Island Templateroller

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Irs Form 945 How To Fill Out Irs Form 945 Gusto

State Of Rhode Island Division Of Taxation Division Rhode Island Government

State Of Rhode Island Division Of Taxation Division Rhode Island Government

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

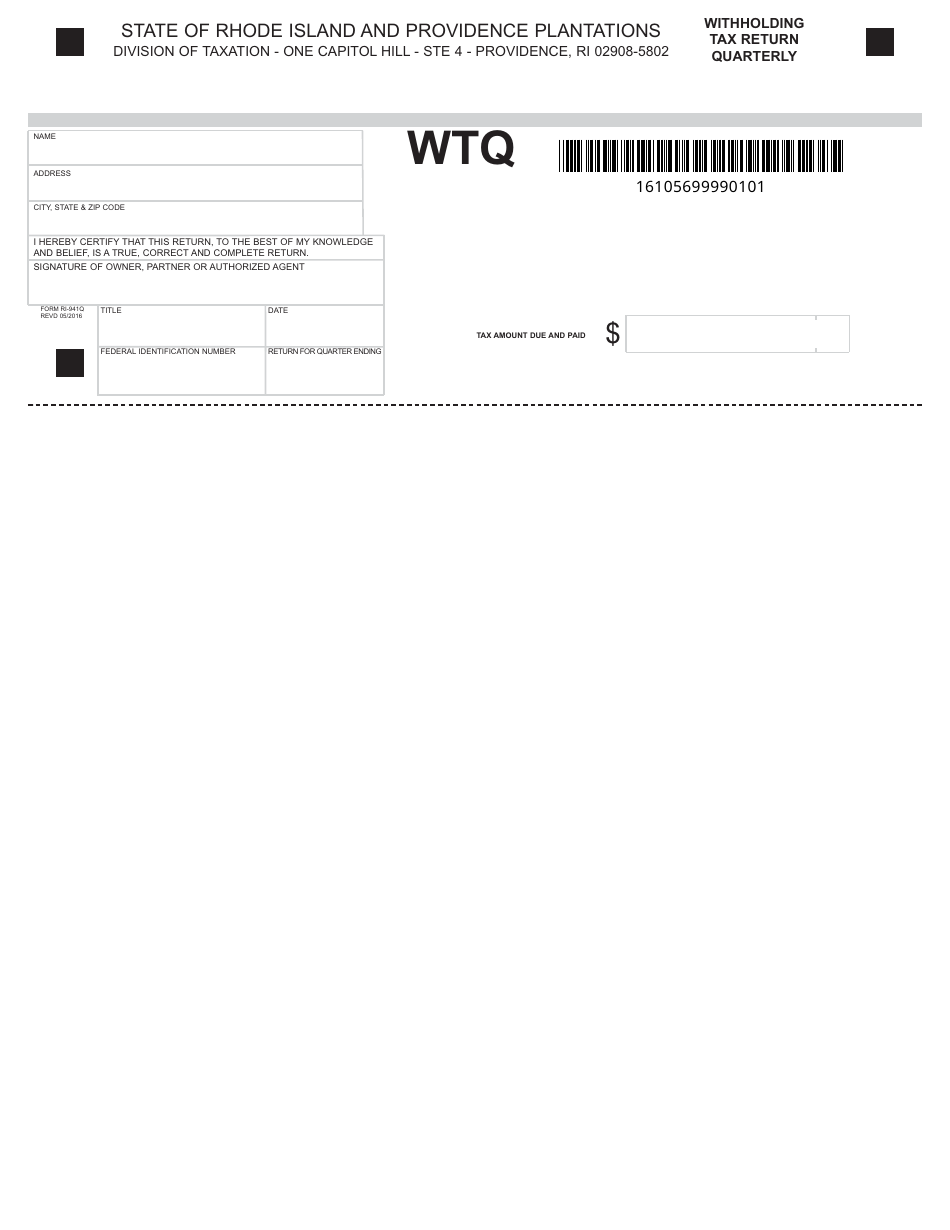

Form Wtq Download Fillable Pdf Or Fill Online Withholding Tax Return Quarterly Rhode Island Templateroller

Improved Tax Withholding Estimator Now Available Pg Co

Form It 2104 New York State Tax Withholding South Colonie

State W 4 Form Detailed Withholding Forms By State Chart

State Income Tax Withholding Considerations A Better Way To Blog Paymaster